Start for free and we will maximize your case success.

Fast, effective, and trusted.

Why start your case with us

Up to 3.5x more compensation

compared to insurance

Start for 100% free

for all case types

No fee unless you win. Guaranteed.

The statement regarding up to 3.5X compensation references a third-party Insurance Research Council study comparing settlements of claimants who retained attorneys versus those who did not.

The statement regarding up to 3.5X compensation references a third-party Insurance Research Council study comparing settlements of claimants who retained attorneys versus those who did not.

Why start your case with us

compared to insurance

for all case types

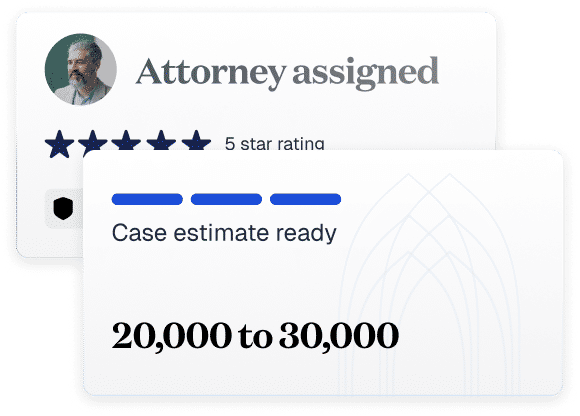

Find out your insurance dispute accident case value easily and quickly

Submit your info or give us a call

We analyze your case & fight on your side

We'll call you back to discuss case value

Work with proven advocates dedicated to maximizing your settlement or verdict.

Awards shown reflect recognitions of independent attorneys or law firms with whom Westwise Group LLC may associate with. For award details, please refer to the granting organization.

Your insurer denies a valid claim without a legitimate reason, violating the terms of your policy.

The insurance company offers you significantly less than what your claim is actually worth.

The insurer unreasonably delays the investigation or payment of your claim to pressure you into accepting a lower settlement.

If you are sued for an accident, your insurer has a duty to defend you. Partner attorneys handle cases where they refuse.

The insurance company misleads you about your coverage or the terms of your policy.

Your own insurance company refuses to pay out a valid claim under your UM/UIM coverage.

This occurs when an insurer refuses to pay a legitimate claim that should be covered under your policy. They might invent reasons for the denial or misinterpret the policy language in their favor. An insurance dispute lawyer can challenge the denial and fight to get you the benefits you paid for.

Insurance companies have a duty to conduct a prompt and thorough investigation of your claim. When they fail to do so, or intentionally drag their feet, it can be a form of bad faith. We can help hold them accountable for their delaying tactics.

Insurers are notorious for offering quick, low settlements that don't cover the full extent of a victim's damages. These offers are designed to save the company money. A lawyer can help you calculate the true value of your claim and negotiate for a fair amount.

This happens when an insurance agent or adjuster misleads you about what your policy covers, or tells you that you don't have coverage for a specific loss when you actually do. This is a serious breach of trust that a bad faith insurance lawyer can address.

If you cause an accident and are sued, your liability insurance policy requires your insurer to provide and pay for a legal defense. If they refuse to defend you, they may be acting in bad faith.

Some insurance adjusters use high-pressure tactics or make intimidating statements to discourage claimants from pursuing the full value of their claim or hiring an attorney. This is an unacceptable practice that we can fight against.

Have more questions? Our team is here to answer them.